Restaurant Accounting 101: Manage Your Bookkeeping Like a Pro

It’s great that a customer raved about a dish, but what are the numbers telling you? Your POS can give you deep insights on best and worst sellers, menu sales trends over time, and your inventory status. If how to do bookkeeping for a restaurant you would like more helpful insights and tips for small businesses, be sure to head on over to our Resource Hub. You’ll find information on how to start a business in the UK, tax essentials, and much more.

Profit and Loss (P&L) Statement

- This is not the unique part; what is different here is how all the line items that are pertinent on a P&L, income statement or a balance sheet report affect restaurant reporting.

- Along with your POS, accounting software helps you keep an eye on your financial performance in real-time.

- If you’re monitoring these figures on a weekly basis, you can patch any cost leaks without incurring too many damages.

- Schedule a demo at a time and date that works for you to learn more about how Tripleseat can help you build and streamline your events and private dining business.

- She enjoys applying her industry experience to her work for Toast’s Content Marketing Team.

- Keeping labor costs under control is one of the most important factors of a restaurant’s profitability.

Record invoices and receipts in your accounting software under “Cost of Goods Sold (COGS).” This provides an accurate picture of your expenses and helps in understanding your food cost. Restaurant owners can use various forms of accounting software to simplify their business and increase the accuracy of their financial data. Accounting software is a great way for restaurant owners to manage all aspects of their restaurant’s finances from anywhere, at any time, and on any device; including desktop or mobile devices. In addition to our accounting and bookkeeping services, we also provide payroll help and tax preparation. While restaurants typically have more complex accounting systems because food is the primary driver of their business, many of the same principles can be applied to accounting for bars. He started in the dish pit and worked his way up to management, where he helped several restaurant owners cut their costs, effectively manage their staff, and fine tune their operations.

How Does Location Affect Food Costs?

Download our free playbook and learn how to build a more resilient business post-pandemic. Great food, brilliant customer service and all-round stellar dining experiences are probably why you got into restaurants in the first place. Running a restaurant is no small job, even before you consider accounting responsibilities. Consider how restaurant software can lighten your administrative burden. Think of it as a filing system for your restaurant’s financial transactions, each labeled for easy identification and analysis.

The Importance of Accurate Restaurant Accounting

Still, I’m hoping you’ll join me as the guest chef in my figurative accounting kitchen. Make sure that your staff are in the right place at the right time, for optimal customer satisfaction. Plan the right people at the right times and save valuable time and money in your store. In tip pools, all tips are collected into one pot and distributed according to a reasonable formula that employees have agreed to participate in. Employees must be notified that they are participating in a tip pool, as well as the details of how the tip pool will be administered.

Food costs depend on the type of restaurant, but normally are around 28-35% or revenue. Accrual-basis businesses rely on the cash flow statement to analyze their cash position. Accrual-basis income statements reflect revenue and expenses the company has recognized, which can differ from the cash that has come in or left the business.

- Now that you have a better understanding of the basics of restaurant accounting and what makes this industry’s financials unique, you can take steps toward ensuring your business’s accounting is in order.

- Restaurant service charges seem to be working for a lot of people—just not at the taxation level.

- Saif Alnasur used to work in his family restaurant, but now he is a food influencer and writes about the restaurant industry for Eat App.

- So here are the essentials of restaurant accounting and bookkeeping when it comes to reports, processes, and KPIs.

What key performance indicators should you track?

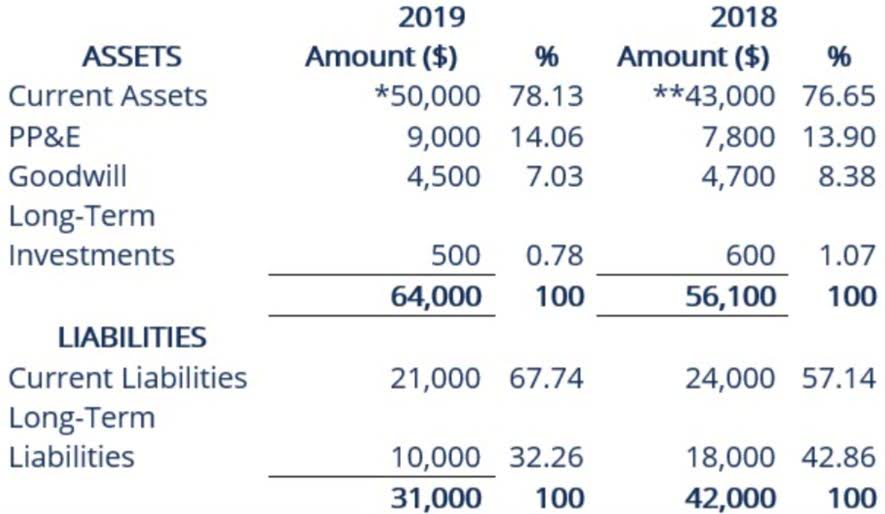

The difference between assets and liabilities is equity, also called the net book value of a company. Before you pay employees their earned tips, you’re required to have a tips payable account in your chart of accounts to recognize the obligation. Tips are not revenue to your business, as you’ll see in the journal entry in the next category.

Choose the Right Accounting Method

“The food is normally purchased on a weekly basis and many times more than once per week depending on the types of food being sold in the restaurant. Most restaurants would have an inventory turnover of times for food and times for beverages,” he said. When you throw out food that’s gone bad, you should note it in your accounting records by debiting a spoilage expense account and crediting an inventory account. For small business owners and employers in the restaurant industry, financial literacy is not just an option; it’s a necessity for sustainable success. By avoiding these common mistakes and adhering to best practices, restaurant owners can ensure a robust and healthy financial foundation, paving the way for sustained success in the competitive restaurant industry. The cost-to-sales ratio is a key metric in understanding the financial health of your restaurant.

Food cost percentage is the amount of revenue you need to spend on food. Some restaurants choose to have a daily accounting period as it allows them the flexibility of being able to update their books at any time during the month. This can be useful if you are looking for specific information on an ongoing basis or need up-to-date sales data to make good decisions about marketing and staffing. Accounting is the systematic way to record, classify and analyze business transactions to make better decisions for your restaurant or foodservice business.

- Basic data entry errors include transposed numbers, misplaced decimals, and incorrect POS system entries, errors that can snowball when using manual accounting processes.

- The Blumenauer bill would create a similar system to the tip tax credit, allowing restaurants that use service charges to take a credit if the money goes directly to employees.

- XtraCHEF’s costing tools provides Cost Trend Reports and Declining Budget features to improve decision-making and help you boost your bottom line.

- Overhead rates are fixed costs of running your business, such as rent and insurance.

- It records income as it enters your bank account and records expenses when they’re paid.