IC Markets are my top choice as I find they have tight spreads, low commission fees, quick execution speeds and excellent customer support. FOREX.com, registered with the Commodity Futures Trading Commission (CFTC), lets you trade a wide range of forex markets plus spot metals with low pricing and fast, quality execution on every trade. To reiterate, the stop loss on this short trade should be located above the high point of the inside day as shown on the image above. The proper location of your stop loss is slightly beyond the inside candle’s top, or bottom, depending on the direction of the break.

- Price is deciding either to reverse the trend completely or come back inside the MA to continue its previous trend.

- See that the highest and the lowest points of the small bullish candle are fully contained within the previous bearish candle.

- Many retail traders use the harami candlestick pattern as an entry point.

- The size of every next wave will be shorter than the previous wave.

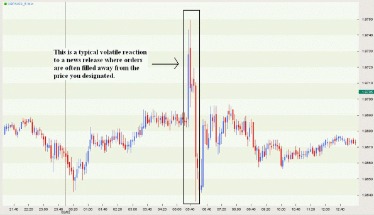

The inside bar should have a higher low and lower high than the mother bar (some traders use a more lenient definition of inside bars to include equal bars). On a smaller time frame such as a 1 hour chart, a daily chart inside bar will sometimes look like a triangle pattern. In the EUR/GBP chart below, the preceding trend is seen by lower lows and lower highs.

How to Trade the Inside Bar Pattern in Forex

The high and low of inside bar candlestick will be within the range of high and low of mother candlestick. If you read the psychology of each candlestick pattern, you’ll learn a lot of advanced price action techniques. First, find an inside bar pattern at the break of support zone using the inside bar indicator. After this, wait for the break of the high of the inside candlestick and then open a buy trade. When an NR7 forms, followed by an Inside Bar, and the high of the Inside Bar is breached, it may signal a potential bullish breakout.

Stock Market Highlights: Nifty forms Inside Bar candle on daily chart. What traders should do on Thursday… – Economic Times

Stock Market Highlights: Nifty forms Inside Bar candle on daily chart. What traders should do on Thursday….

Posted: Thu, 06 Jul 2023 07:00:00 GMT [source]

When this happens the previous bar is known as the mother bar. It does not matter if the Inside Bar is bullish or bearish, all that matters is where the Inside Bar prints relative to existing price action. This is one of the most popular technical chart patterns around and there are several trading strategies that utilize this pattern. Before we get into actual trading strategies, let’s see at what an Inside Bar looks like, what it can tell us, and why it happens.

Inside bar breakout strategy

If the low of the inside bar breaks before the high, then we will immediately delete the pending order. Confirm that the current bar (inside bar) is entirely contained within the range of the NR7 bar. The first candle is also known as a mother bar, and the second is called the baby bar.

The inside bar formation is completed when the second candle closes within the body of the mother candle. So now we know where to enter the inside bar trade, but to really understand why relative size is important we need to understand where to place our stop loss order. The best place to enter an inside bar is on a break of the mother bar high or low in the direction of the trend. Here’s how I would’ve entered the inside bar trade we looked at earlier.

Inside Bars – The Hidden Price Action Driver

On the surface this looks like a valid inside bar trade setup. We have an inside bar on the daily chart in a strong downtrend…everything looks good. They often provide a low-risk place to enter a trade or a logical exit point.

This inside bar strategy is based on the fact that price decides its direction from key levels. But if there is an inside bar at the key level then it will make it easy to forecast the direction of the market. The Inside Bar Candlestick Pattern can be used on your trading platform charts to help filter potential trading signals as part of an overall trading strategy. Sometimes the Inside Bar occurs when there is pressure from sellers and buyers. This shows indecision in the market as both of them were unable to push the price higher or lower.

Forex Categories

The blue circle on the price graph above shows an inside bar candlestick pattern. See that the highest and the lowest points of the small bullish candle are fully inside bar forex contained within the previous bearish candle. The black horizontal lines on the image define the inside bar range – the high and the low of the pattern.

10 Important Price Action Patterns to Master • Benzinga – Benzinga

10 Important Price Action Patterns to Master • Benzinga.

Posted: Thu, 02 Mar 2023 08:00:00 GMT [source]

Nial Fuller is a Professional Trader & Author who is considered ‘The Authority’ on Price Action Trading. He has a monthly readership of 250,000+ traders and has taught over 25,000+ students since 2008. Stop loss placement is typically at the opposite end of the mother bar, or it can be placed near the mother bar halfway point (50% level), typically if the mother bar is larger than average. The real benefit of trading that most people miss is that it’s one of the most direct paths to deep personal development. To start tracking Inside Bars on your charts, use one of our handy alert indicators. Regardless of how you define a trend, spend a lot of time in Forex Tester or using screenshots to look at many different types of trends.

A conservative trader would identify the ID NR4 breakout when the price action closes a candle below the bottom of the pattern. An aggressive trader would identify the ID NR4 breakout when the price reaches a few pips below the bottom of the pattern. In each case, it would signal that the consolidative range is ending in favor of a downward price movement. A trader could prepare to enter a short position, and put in a stop loss above the high point of the pattern as shown on the image. Furthermore, occasionally it may appear inside another chart pattern formation, such as the three inside-up pattern when the first two candles are in fact inside bars.

Traders can consider going long (buying) on the currency pair. The last 3 inside bars on the chart in this video have all acted as turning points or stall points. The inside bar strategy can act as a catalyst for an event in the market , this event is usually a simple turning point, stalling signal, or a false break.

Price will reverse its trend if it breaks the low of the inside bar. You will also want to use multiple timeframes to confirm the validity of the inside bar pattern. One important characteristic of the inside bar pattern is its relationship to the prevailing trend.

Risk-to-Reward Ratio

It is important to learn the structure of the inside bar pattern. It tells the traders that the market is looking for direction. Big institutions and big traders are deciding either to upward or downward. The inside bar is the exact opposite of the https://g-markets.net/ engulfing candlestick. This illustrates a form of equilibrium in the market – and this is something the trader can use. Unlike the engulf, however, there’s only one type of inside bar – and it needs to print entirely inside of the prior formation.