What Is the Accounting Equation Formula?

This straightforward relationship between assets, liabilities, and equity is considered to be the foundation of the double-entry accounting system. That is, each entry made on the debit side has a corresponding entry (or coverage) on the credit side. As its name implies, the Accounting Equation is the equation that explains the relationship of accounting transactions. The Accounting Equation states that assets equals the total of liabilities and equity. Shareholder Equity is equal to a business’s total assets minus its total liabilities.

Understanding how to use the formula is a crucial skill for accountants because it’s a quick way to check the accuracy of transaction records . It’s important to note that although dividends reduce retained earnings, they are not expenses. Therefore, dividends are excluded when determining net income (revenue – expenses), just like stockholder investments (common and preferred). Now that you are familiar with some basic concepts of the accounting equation and balance sheet let’s explore some practice examples you can try for yourself. In accounting, we have different classifications of assets and liabilities because we need to determine how we report them on the balance sheet.

Balance Sheet and Income Statement

You can find a company’s assets, liabilities, and equity on key financial statements, such as balance sheets and income statements (also called profit and loss statements). These financial documents give overviews of the company’s financial position at a given point in time. The accounting equation ensures the balance sheet is balanced, which means the company is recording transactions accurately. Accounting equation describes that the total value of assets of a business entity is always equal to its liabilities plus owner’s equity.

Additional Resources

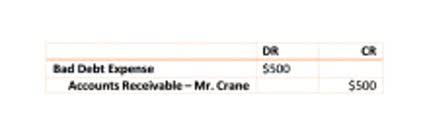

Accounts receivable list the amounts of money owed to the company by its customers for the sale of its products. Assets include cash and cash equivalents or liquid assets, which may include Treasury bills and certificates of deposit (CDs). A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. However, this scenario is extremely rare because every transaction always has a corresponding entry on each side of the equation.

The accounting equation is also called the basic accounting equation or the balance sheet equation. To calculate the accounting equation, we first need to work out the amounts of each asset, liability, and equity in Laura’s business. Like any brand new business, it has no assets, liabilities, or equity at the start, which means that its accounting equation will have zero on both sides. Additionally, you can use your cover letter to detail other experiences you have with the accounting equation. For example, you can talk about a time you balanced the books for a friend or family member’s small business. Accountants and members of a company’s financial team are the primary users of the accounting equation.

This equation is the foundation of modern double entry system of accounting being used by small proprietors to large multinational corporations. Other names used for this equation are balance sheet equation and fundamental or basic accounting equation. If a company keeps accurate records using the double-entry system, the accounting equation will always be “in balance,” meaning the left side of the equation will be equal to the right side. The balance is maintained because every business transaction affects at least two of a company’s accounts. For example, when a company borrows money from a bank, the company’s assets will increase and its liabilities will increase by the same amount.

Ask a Financial Professional Any Question

For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability. As expected, the sum of liabilities and equity is equal to $9350, matching the total value of assets. So, as long as you account for everything correctly, the accounting equation will always balance no matter how many transactions are involved.

Assets represent the valuable resources controlled by a company, while liabilities represent its obligations. Both liabilities and shareholders’ equity represent how the assets of a company are financed. If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity. This refers to the owner’s interest in the business or their claims on assets after all liabilities are subtracted.

In the basic accounting equation, assets are equal to liabilities plus equity. The accounting equation plays a significant role as the foundation of the double-entry bookkeeping system. The primary aim of the double-entry system is to keep track of debits and credits and ensure that the sum of these always matches up to the company assets, a calculation carried out by the accounting equation. It is used to transfer totals from books of prime entry into the nominal ledger. Every transaction is recorded twice so that the debit is balanced by a credit.

For example, an increase in an asset account can be matched by an equal increase to a related liability or shareholder’s equity account such that the accounting equation stays in balance. Alternatively, an increase in an asset account can be matched by an equal decrease in another asset account. It is important to keep the accounting equation in mind when performing journal entries.

Free Resources

- A company’s quarterly and annual reports are basically derived directly from the accounting equations used in bookkeeping practices.

- Alternatively, an increase in an asset account can be matched by an equal decrease in another asset account.

- For example, if the total liabilities of a business are $50K and the owner’s equity is $30K, then the total assets must equal $80K ($50K + $30K).

- To calculate the accounting equation, we first need to work out the amounts of each asset, liability, and equity in Laura’s business.

- 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Obligations owed to other companies and people are considered liabilities and can be categorized as current and long-term valuation and modelling liabilities. To make the Accounting Equation topic even easier to understand, we created a collection of premium materials called AccountingCoach PRO. Our PRO users get lifetime access to our accounting equation visual tutorial, cheat sheet, flashcards, quick test, and more. Assets typically hold positive economic value and can be liquified (turned into cash) in the future.

The total dollar amounts of two sides of accounting equation are always equal because they represent two different views of the same thing. The accounting equation states that a company’s total assets are equal to the sum of its liabilities and its shareholders’ equity. The accounting equation asserts that the value of all assets in a business is always equal to the sum of its liabilities and the owner’s equity.

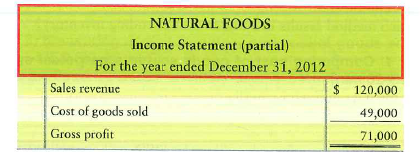

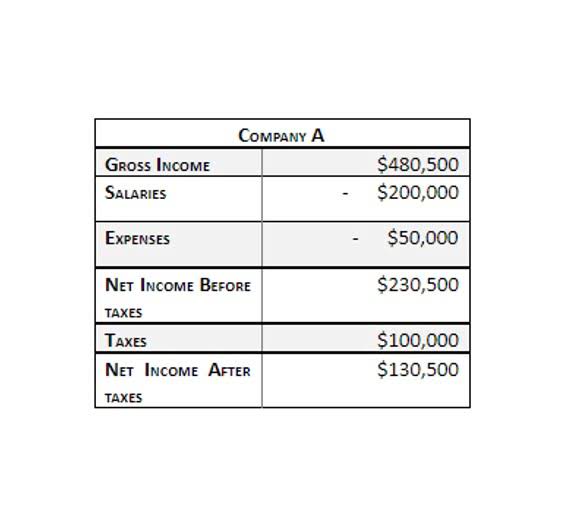

The income statement is also referred to as the profit and loss statement, P&L, statement of income, and the statement of operations. The income statement reports the revenues, gains, expenses, two teach limited losses, net income and other totals for the period of time shown in the heading of the statement. If a company’s stock is publicly traded, earnings per share must appear on the face of the income statement. The income statement is the financial statement that reports a company’s revenues and expenses and the resulting net income. While the balance sheet is concerned with one point in time, the income statement covers a time interval or period of time. The income statement will explain part of the change in the owner’s or stockholders’ equity during the time interval between two balance sheets.