New wave of FDI landed in industrial zones

In the past five months, industrial real estate has been bustling with Asian – European – American investors to approach the market, opening a new growth momentum.

In mid-May, Danish jewelry brand Pandora signed a memorandum of understanding to build a new jewelry manufacturing facility at Vietnam – Singapore Industrial Park III (VSIP) in Binh Duong province. This will be the company’s third production site and the first outside of Thailand.

Germany’s Framas Group has also just rented a ready-made factory area of 20,000 m2 in KTG Industrial Nhon Trach 2 project (Dong Nai). Framas specializes in the production of high-quality plastic parts for customers such as Nike and Adidas.

Fuchs Group, a German lubricant giant, at the end of the first quarter, announced the expansion of operations in Vietnam with the move to lease a 20,000 m2 land area in Phu My 3 Specialized Industrial Park (PM3 SIP) in Ba Ria – Vung Tau to build new factory. The land lease contract is for 55 years, showing the long-term commitment in Vietnam of the German lubricant manufacturer with more than 90 years of experience.

The Central region has also become a destination to attract many new investors. Arevo Inc. from the US wants to invest in a 3D printer factory (135 million USD) in Da Nang Hi-Tech Park; United States Enterprises plans to set up a semiconductor factory here worth 110 million USD or the Fujikin Research, Development and Production Center ($35 million) also located in Da Nang Hi-Tech Park…

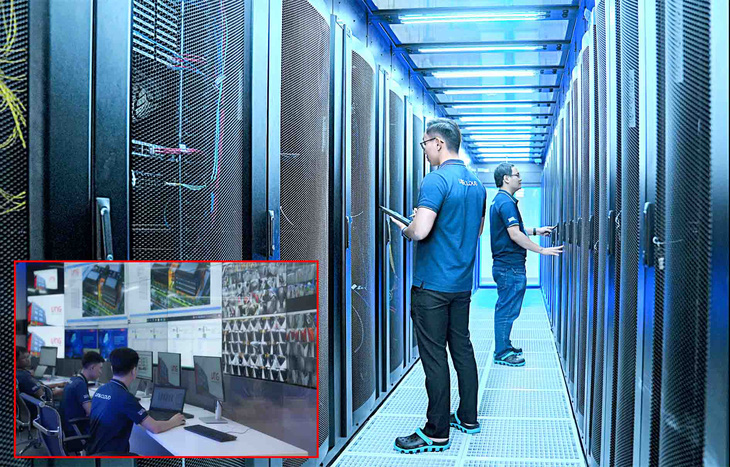

A corner of the Vietnam-Singapore industrial park in Binh Duong is seen from above. Photo: Quynh Tran

Meanwhile, the Northern region continues to attract capital flows from Singapore, Korea, Taiwan and Japan investors – players who entered the market very early and are constantly expanding its scale in the industrial capitals of the North.

CapitaLand Development at the beginning of the year signed a memorandum of understanding to invest one billion USD with Bac Giang province to develop CLD’s first industrial, logistics and urban area in Vietnam. BW Industrial Development Joint Stock Company has acquired DEEP C Industrial Park with an area of about 74,000 m2 in Bac Tien Phong Industrial Park, Quang Ninh Province.

Thai Nguyen only attracted 924 million USD in FDI in the first two months of the year, accounting for nearly 18.5% of the total FDI capital in the country during the period. Prominent among them is the additional capital of 920 million USD of Samsung Electro-Mechanics Vietnam Co., Ltd., belonging to Samsung Group (Korea). As a result, raising the total investment capital in Yen Binh Industrial Park in Pho Yen town (Thai Nguyen) to 2.27 billion USD (nearly 52 trillion VND).

Experts at the Vietnam Industrial Real Estate Forum 2022, on May 24, also assessed that a new wave of FDI has been booming in the past 5 months, when Vietnam returns to the “new normal” and brings Covid-19 under control. This opens up many development opportunities for industrial capitals in the upcoming time.

Ms. Trang Bui, General Director of Cushman & Wakefield Vietnam, assessed that new FDI sources pouring into Vietnam’s industrial parks in 2022 are tending to develop in two branches. The first is the manufacturing industry and the second is auxiliary logistics, i.e. industrial real estate that supports production and logistics.

According to Ms. Trang, with the explosion of e-commerce in recent years, many Asian investors such as Singapore, Japan, Hong Kong, Korea… and a whole group of investors from the US, Europe have also appeared in Vietnam’s industrial real estate market. With a group of investors landing in the Vietnamese market in the period of 2022, there is a tendency to seek higher and higher quality logistics real estate.

And Mr. Fabian Urban, Head of Footwear Technology at Framas Vietnam, said the reason for choosing Vietnam to open the factory was because of its superior facilities compared to other locations. “The establishment of the new factory is part of the Group’s strategy to develop the footwear sector in Vietnam,” Urban said.

Mr. Lance Li, General Director of BW Industrial Company, forecast that the industrial real estate market in Vietnam will have many prospects to welcome new capital this year. According to him, a positive signal is shown in the PMI of Vietnam’s manufacturing industry, which recorded growth for 7 consecutive months.

CEO Cushman & Wakefield said that Vietnam’s logistics market is still in the early stages of development but has great potential for growth in the next 5-10 years when the Vietnamese Government is stepping up investment in infrastructure. In addition, the strong growth of the middle class with high disposable income and the strong spread of e-commerce will be the driving forces for the development of the logistics market.

Source: VnExpress