According to Trading Economics, industrial output in Vietnam increased by 11.6 percent year on year (YoY) in May of 2021, dropping from a 22.2 percent increase in April.

This was the third month in a row that industrial production increased because of the continuing epidemic. In the first five months of the year, industrial production increased 9.9 percent compared to the same time in 2020.

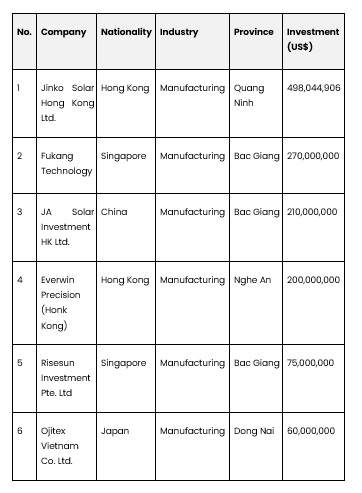

Jinko Solar and Fukang Technology from Hong Kong and Singapore invested US$498 million and US$270 million in Quang Ninh and Bac Giang, respectively, in 5M/2021 manufacturing projects.

Companies must approach their capital requirements cautiously during this period of instability.

Capital injections from company balance sheets can be necessary to achieve any short or medium-term goals.

Unlocking the importance of the buildings we own and use daily will be an effective way to accomplish these goals.

The sale and leaseback of real estate is a well-established way for landowners to release money from their holdings.

What is a sale-leaseback?

What is a sale-leaseback? Sale-leaseback is a common strategy for businesses that buy real estate or industrial land and convert their properties into cash to fund operations.

It is a very particular form of a financial instrument where one party (the seller/lessee) that owns an asset sells the asset to the second party (the investor/landlord).

The benefits of sale and leaseback

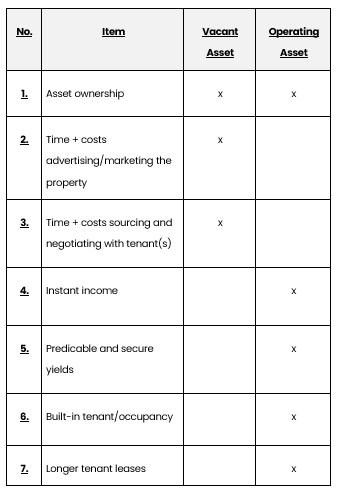

A sale and leaseback agreement may benefit both the buyer and the seller. The seller attains a lump sum of cash quickly and the buyer acquires a lower than the market value purchase price, along with a long-term lease at a premium rate.

Once a landowner sells their stake in a freehold estate, they enter into a rent-paying relationship with the same party, who will receive periodic payments for a fixed term.

They can transfer all of the money from acquiring or consolidating the land into core operations or can reallocate the investments in those properties to other locations.

Industrial property owners can use a sale and leaseback for any asset type, including industrial land, factories, and warehouses.

The new owner (the investor) benefits from a guaranteed income stream for a specified time.

Vacant Asset Acquisition vs Sale-Leaseback/Operating Asset Acquisition

Frequently asked questions about a sale-leaseback:

Why would you do a sale-leaseback? A company can consider a sale-leaseback arrangement only if it owns the real estate on which it performs its primary operations. When a company’s core business profit margins exceed the returns offered by real estate, it should consider a sale-leaseback.

- The primary benefit of the deal is financial, as it allows the operating company to use the cash provided from the real estate to finance their core business activities.

- They intend to use the net proceeds from the sale to finance progress, debt reduction, cash dividends and a wide range of other purposes.

- A sale-leaseback allows you to recover the cost of an estate by freeing up the funds invested in it.

How do you calculate a lease factor? The yearly interest rate embedded in the lease is referred to as the lease factor. It is calculated by dividing the lease fee by the product of the lease period and the total of capitalized and residual expenses. You can calculate the monthly lease factor by dividing the annual rate by 12.

What is the process of a sale and leaseback? The lease element is the lease’s annual interest rate. It is calculated by dividing the lease fee by the product of the lease term multiplied by the amount of capitalized and residual costs. Divide the annual rent by 12 to obtain the monthly lease factor.

How does an equipment sale-leaseback work? Via a sale-leaseback, you can fund equipment such as oil rigs, marine vessels, aircraft and other properties. Then you acquire the asset as a seller-lessee, borrowing it from the buyer-lessor. As a result, investors gain some financial and tax incentives in addition to the extra cash liquidity from equipment disposal and leaseback.

Though there are no promises for next year, Savills Industrial Real Estate Services believes in Vietnam’s industrial sector’s dependence on continued supply chain migration out of China remains evident as many landlords are preparing for a busy and prosperous year until these restrictions are lifted.

Conclusion

By the 20th of May 2021, Vietnam had attracted a total of US$13.9 billion in registered FDI. Manufacturing and processing received US$6.1 billion (43 percent of total inflows), with 215 new projects spending US$2.57 billion and 222 existing businesses raising US$3.1 billion.

Almost all investors in any troubled sector must deal with one of the epidemic and must pursue either an expansion or the rehabilitation of any down market situation through an acquisition. Because of the economic insecurity, businesses must consider their flexibility and adaptability.