A number of factors make the country an attractive destination for industrial investors to invest in Vietnam real estate, including the country’s strategic position, a large pool of skilled workers at competitive wages, and a climate that is reasonably welcoming to foreign direct investment.

In order to assist international companies and foreign investors in better understanding the important trends in the Vietnamese FDI environment and in taking advantage of new possibilities in the nation, here are 5 ways to efficiently invest in Vietnam real estate.

An Overview of Vietnam Real Estate in 2022

Businesses were compelled to use the “three on the spot” and “one route, two destinations” models to keep up output during the last couple of years. When pandemic restrictions differed from region to region, this caused supply networks and manufacturing to be disrupted.

As a result of the massive disruption, businesses were desperate for a clear plan of action from the federal government. In the third quarter of this year, Vietnam saw negative GDP growth as a result of the epidemic. A 10-year high of 1.8 million people lost their jobs, with an unemployment rate of 3.98% compared to 2.73% last year. So far in 2021, around 90,300 companies have ceased operations.

Despite the epidemic, FDI in Vietnam has done rather well in the previous 11 months of 2021. As of November 20, 2021, FDI inflows totaled roughly US$26.46 billion.

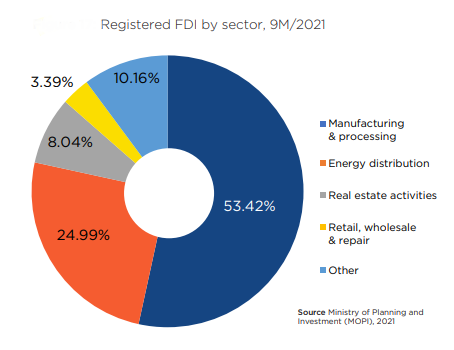

The biggest recipients of FDI dollars were manufacturing and processing, followed by energy production and distribution, real estate, and wholesale and retail trade in general. Major investors in Vietnam included the Republic of Korea, the United States and Japan. The United States, China, the European Union, the Association of Southeast Asian Nations (ASEAN), and South Korea are among Vietnam’s biggest export partners, while the People’s Republic of China, South Korea, the ASEAN, Japan, and the European Union are among its top import partners.

Even now, raw minerals are still a major part of Vietnam’s economy. To the United States, the European Union, and China, Vietnam’s products are predominantly exported.

Why You Should Invest in Vietnam Real Estate in 2022

Despite the epidemic, the foundations of Vietnam’s market and economy remain solid. In the first eleven months of 2021, exports totaled 299.67 billion USD, an increase of 17.5% over the same period in the previous year. The immunization program in Vietnam has been swiftly implemented. A number of corporations, including LG and Lego, have declared ambitions to expand their manufacturing operations in Vietnam, with the latter recently announcing plans to establish a 1 billion USD facility in Binh Duong.

A number of free trade accords, including the CPTPP, EVFTA, and UKVFTA, have been centered on Vietnam. A year later, in 2022, the RCEP is scheduled to go into force.

Because of the trade dispute between the United States and China, Vietnam’s low manufacturing prices have made the country a desirable investment location. The business environment and labor prices in Vietnam are well-known for their allure.

For regional distribution or even worldwide import and processing, it has become the standard. As a result of Vietnam’s trade agreements and low tariffs, the country has seen an increase in exports. In order to meet the socio-economic development plan’s core objectives for 2021-2025, including a target of 6.5-7% average GDP growth, a clear road map for economic recovery is also being developed.

Considerations for Investing in Vietnam Property

Vietnam’s Rapidly Growing Economy

It is estimated that the economy of Ho Chi Minh City, the capital of Vietnam, is rising at a rate of 6–7% annually. As the cost of manufacturing in China rises, more and more multinational firms are shifting their attention to Vietnam.

Increased manufacturing would benefit not just the main cities, but also “minor” ones like Bien Hoa, which will experience a boost in real estate demand. As a result of the PWC Emerging Trends in Real Estate Asia Pacific report, Ho Chi Minh City is ranked as one of the greatest locations to be right now.

Planned Infrastructure Investment On The Way

Ho Chi Minh City and other Vietnamese cities are rapidly expanding and integrating with one other. There is a lot of investment planned for residential developments, as well as industrial zones being expanded all throughout the big key zones and the surrounding areas.

In cities like Ho Chi Minh City, despite the fact that property prices have risen, they remain significantly low compared to Bangkok, Shanghai, Singapore, and Hong Kong on the average.

Increasing on Foreign Investments

Until 9M/2021, committed FDI was $22.1 billion, with 1,212 new projects totaling $12.49 billion in capital investment. Long An received US$3.6 billion in FDI, representing a 16.42% increase. Other top beneficiaries were Hai Phong (12.2%), Ho Chi Minh City (10.6%), and Binh Duong (8.0%). Singaporean investments totaled US$6.28 billion, accounting for 28.37% of registered FDI, followed by Korean investments totaling US$3.91 billion, or 17.67%, and Japanese investments totaling US$3.26 billion, or 14.75%.

The manufacturing and processing industry received US$11.83 billion in FDI with 402 new projects, accounting for 53.4 % of the total and growing 16.45% year-on-year.

5 Effective Strategies to Invest in Vietnam Real Estate in 2022

With the introduction of new industrial zones and projects in 2021, there will be more essential supply. Especially in these segments:

– Industrial Land

Opportunity from booming demand for e-Commerce and industrial production has encouraged corporations to actively seek large-scale industrial land and warehousing projects in vital areas and near to major economic centers, particularly as land becomes more scarce during the 2020-2021 period, making 2022 look more and more promising.

Dozens of industrial zone projects were authorized in 13 cities and provinces in Q1/2021, offering thousands of hectares to meet future demand.

– Warehouse

The logistics industry in Vietnam is quickly rising as a result of the country’s expanding economic, industrial, and e-Commerce sectors. Vietnam’s logistics business is rapidly increasing as a result of the country’s expanding economic, industrial, and e-commerce sectors. The nation advertises itself as an export-driven economy, with the government aiding industrial enterprises (and the money they attract) via the establishment of economic zones and intellectual property (IP).

Vietnam will be one of the top 10 emerging logistics markets in 2021, according to Agility, a well-known freight and logistics business. It rose three places in 3 days, one of the fastest in the world, to finish ninth overall out of 50 countries. As a result, the need for storage facilities has increased.

– Cold storage

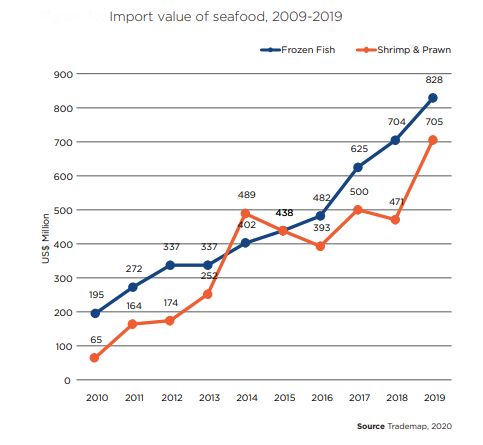

With Asia’s increasing middle class and mature economies, demand for items like safe and high-quality food will continue to rise, with the exponential expansion of Viet Nam’s grocery industry and contemporary retail trade being major cold storage drivers.

Viet Nam’s cold chain logistics is expanding, and predictions predict that it will be valued at $295 million by 2025, with a 12% annual growth rate. Despite rising demand, cold storage facilities are few, with just 48 available in 2019. Long construction durations and expensive expenses have led to restricted supply and significant rent hikes ranging from $52 per tonne in early 2020 to $87 per tonne in 2021.

The primary components are commercial cold storage and self-operating facilities, with the seafood processing industry leading the self-operating market.

– Factory

Along with the growth of the logistics sector, global corporations are also striving to diversify their supply chains, reduce dependence on China, and boost supply chain robustness and connectivity, Vietnam has emerged as a prominent location for factory investment.

Vietnam’s strategic geographic location near supplier and consumer markets; relatively low-cost, young, tech-savvy workforce; stable government; welcoming approach to Foreign Direct Investment; and integrated network of Free Trade Agreements, which now includes the CPTPP, EVFTA, and RCEP, are all factors in its success.

There have been periodic challenges due to rising expenses of the stay-at-work model and supply chain interruptions, but Vietnam remains one of the world’s top manufacturing facilities, next to China.

Industry 4.0 is attracting the interest of governments all over the world, including Viet Nam. As the nation climbs up the value chain, chances to improve the competence of its manufacturing sector, thus, growing demand for factory for rent.

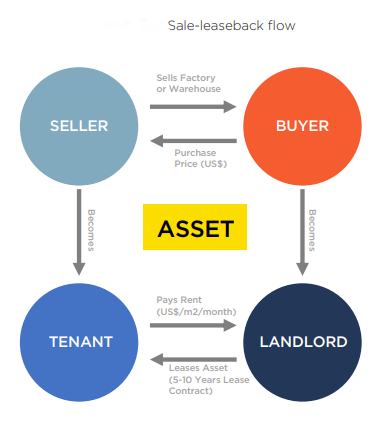

– Sale-leaseback

In Vietnam, sale-leaseback transactions are still underutilized, though the method, which involves selling industrial real estate and leasing it back again, is becoming a wiser and more practical option for businesses, especially after the epidemic and should be seen as a more cost-effective alternative to high-interest bank loans.

DKSH’s warehouse in Binh Duong was the first high-profile sale-leaseback in Viet Nam’s industrial market in 2017. In 2018, Singapore’s Mapletree Logistics Trust invested US$43 million in Unilever’s 66,800 m2 GFA warehouse in Binh Duong.

The property was leased back to Unilever for a ten-year term, providing Mapletree with an initial net yield of 8.%. Savills Industrial Vietnam has successfully negotiated the sale-leaseback of a 36,000 m2 GFA warehouse in Di An in 2020.

As the trend continues, astute investors are aggressively looking for industrial leasebacks.

How to invest in Vietnam real estate as foreign investors

According to a White & Case analysis for 2021, the top three industries for M&A activity by number of acquisitions were industrials and chemicals, consumer products, and real estate. During the first three quarters of 2021, the industrial and chemicals sectors created a total of seven transactions. M&A remains the fastest way for international developers to join the country and for local developers to build their land portfolio in the real estate industry.

In terms of the housing real estate sector, there is a tendency in 2021 of developers seeking land money via M&A agreements in Hanoi and Ho Chi Minh City’s outlying areas. Neighboring provinces with strong links to Ho Chi Minh City, like Vietnam Binh Duong and Dong Nai, still have land available for the development of metropolitan regions and megacities that might become the center of the M&A market. Investors from Japan, Singapore, and South Korea have been drawn to such areas.

Consumer goods manufacturing, industry (energy), real estate, retail, ICT, and logistics are among the areas predicted to have the most active M&A activity in the future years, according to a CMAC Institute report.

Conclusion

“Due to the inability of overseas investors and renters to visit, choose assets, and sign lease contracts, industrial developers have not leased as much property as they had intended this year”, Mr. John Campbell Manager of Industrial Services, Industrial Savills Vietnam commented.

To ensure that Vietnam can bounce back even stronger in 2022, the country has put in place a solid foundation of reforms that enhance the business environment.

Production halts at industries and industrial zones received extensive publicity in the worldwide media.

With both market availability and the government’s willingness to protect the interests of foreign investors, and since the country’s dependence on foreign money is crucial to its economic recovery and advancement, 2022 is more than the ideal moment for international investors to invest.