Currently, Vietnam is a developing country, but with the policy of achieving a GDP growth rate of over 6% for the whole year, investing in real estate in Vietnam in the next 20 years can be a profitable investment. Profits around the world are attracting the interest of inside investors.

As well as important resources for organizational management, the development of the country.

We consider “people (excellent and abundant workforce), goods (supply and demand capabilities), and money (investment capacity)” as very important factors.

Vietnam has been able to meet these excellent equilibrium conditions, and expectations for further development are attracting attention in the future.

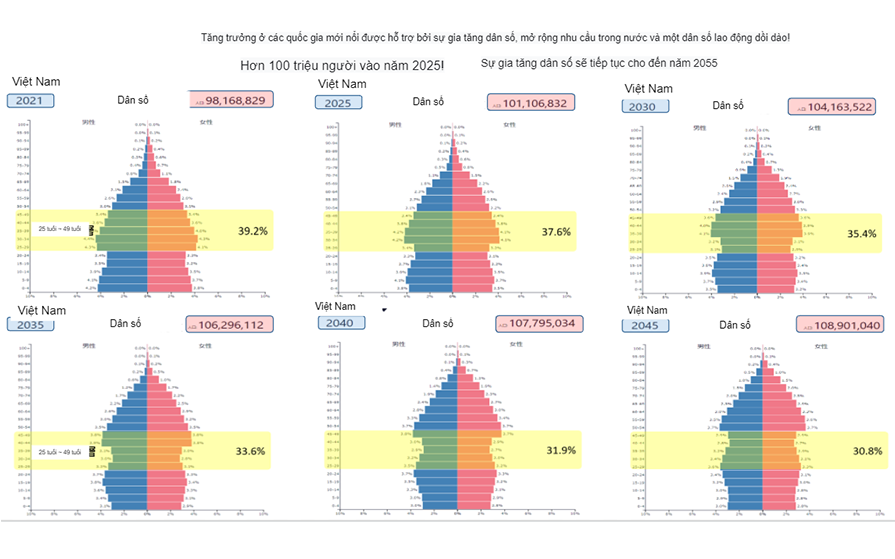

(The population will exceed 100 million by 2025 and the population growth bonus will continue until 2055. * Population MAX forecast 2055 = approximately 110 million)

View analysis

Vietnam GDP growth and demographic dividend is just over 6% (economic growth and population growth will lead to increased real estate demand) Growth in emerging countries is supported by population growth, expanding domestic demand and an abundant working population! More than 100 million people by 2025! Population growth will continue until 2055

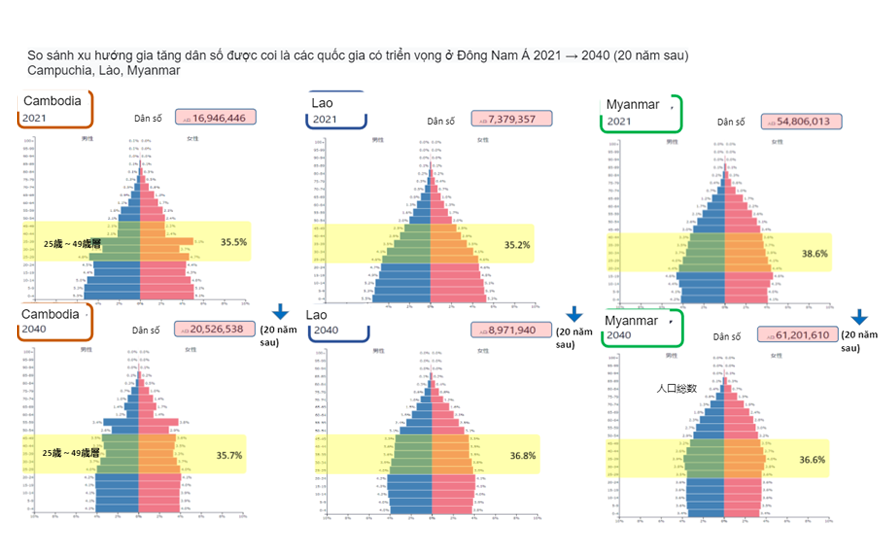

Comparison of population growth trends considered as promising countries in Southeast Asia 2021 → 2040 (20 years later) Cambodia, Laos, Myanmar

The age group Ratio in Japan from 40 years ago and the population cost Ratio in Vietnam are very similar.

EXIMGR Real Estate is actively investing in the promising (real estate) field of Vietnam

The deposit interest rate in Japan, a developed country, is almost 0%, and as long as you deposit at the bank, you cannot increase your deposit.

The average interest rate per year on term deposits of major Vietnamese banks (assets / market capitalization TOP5) is 5.44% per year (* calculated until September 2021).

See more

It is very important to dispel the fear of risk when investing. EXIMGR offers an investment plan for each object

Companies investing in funds or corporations will be notified of investment projects in the land development business (developmental investment).

Individual investors will be guided by small-scale diversified investment.

See market analysis in Vietnam.